Cue Construction 4.0: Make or break time

By KPMG

Construction Leadership SoftwareKPMG 2023 Construction Industry Digital Maturity survey takes an in-depth look at technology adoption in Canada’s construction industry.

The past few years have been, to say the least, challenging for the construction industry. The pandemic, supply chain disruptions, labour shortages, and the surge in material costs disrupted lives and business activity. In response to these challenges, many construction companies came to realize that investments in technology were needed to respond to the new market realities, and improve productivity, workflow inefficiencies, and worker safety.

According to research gathered by KPMG in collaboration with the Canadian Construction Association (CCA) for the 2023 KPMG Construction Industry Digital Maturity survey, two thirds of construction companies say the pandemic prompted them to make “moderate” to “great or considerable” new investments in technology. Most organizations today feel they must adapt their digital strategy to succeed in the new market landscape.

Although only 13 per cent of respondents feel that their company has realized full integration across their value chain from supplier to customer, and 59 per cent feel they are partially integrated, more than eight in 10 companies believe that disruptive technologies can generate savings and efficiencies and make them more competitive.

“This is all about doing more with less,” says Jordan Thomson, a senior manager within KPMG’s Global Infrastructure Advisory group. “There is an amazing level of demand for infrastructure from all sectors that is facing a constrained construction industry and increasing costs. New technologies will help us bridge the gap and deliver more projects more efficiently.”

The decisions that construction companies make today have never been more important, for they will determine how well their organizations will be able to weather the unexpected and seize the coming opportunities.

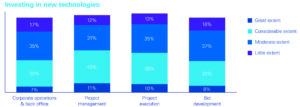

When KPMG conducted its first version of the survey in 2020, digital and technological maturity in the construction industry was “fairly low.” The 2023 survey reveals the industry has made headway, but more needs to be done. COVID-19 hastened many digital journeys: Over two thirds (67 per cent) of respondents say the pandemic spurred new investment in, or assessment of, new technologies for their business. Of the 67 per cent, nearly a third (32 per cent) say the pandemic influenced them to a “great” and “considerable” extent, while 35 per cent say it had influenced them to “a moderate extent.”

Compared to 2020, companies are now shifting more investment dollars into technologies to support project management, project execution, and bid development.

“Technology can help the construction industry address Canada’s housing and infrastructure challenges,” explains Tom Rothfischer, partner, and national industry leader for building, construction, and real estate at KPMG in Canada. “Digital tools, if used smartly, save time and money, reduce waste, and improve worker safety and productivity. In short, they help get projects done on time or ahead of schedule and on budget.”

INDUSTRY OUTLOOK

The industry has tremendous growth potential across the industrial, commercial, institutional, and civil construction sectors, in part fuelled by housing demand, needed maintenance and repairs, government investments, and the transition to the green economy.

In Ontario alone, where the construction industry contributes 7.7 per cent to the provincial economy, construction projects in public transportation, nuclear refurbishment, and other infrastructure and institutional projects will contribute to the growth in non-residential construction, according to StatsCan.

However, the industry is divided in its outlook for the next five years, despite the anticipated need for infrastructure asset replacement and repair, renewable energy projects, and new residential housing.

In the near term, the construction industry is buckling in for a possible recession. Over two-thirds (67 per cent) of construction companies expect an economic downturn in the next 12 months, with a nearly 50-50 split in expectations on whether it will be shallow or deep.

Just over half (54 per cent) believe the downturn will be mild and short investment lived, lasting one or two quarters at most. Forty-six per cent anticipate a more prolonged recession.

Either way, the prospect of a possible recession has not deterred their digital transformation plans.

Nearly seven in 10 survey respondents (69 per cent) who expect a recession are currently either accelerating their digital transformation strategies (60 per cent) or staying the course on their digitalization timetables (40 per cent).

Fewer than a third (31 per cent) are pausing or reprioritizing their digital plans largely to cut their operating expenses and alleviate economic stresses.

While 42 per cent of respondents to the 2023 Construction Industry Digital Maturity survey are significantly or somewhat more optimistic about the sector’s five-year outlook, a third are significantly or somewhat more pessimistic; and a quarter are neutral.

Owners and suppliers have a more optimistic view of the future than general contractors, subcontractors, and consultants like architects, engineers, etc. Nearly half of owners (49 per cent) and two thirds of suppliers (66 per cent) have a significantly or somewhat optimistic five-year industry outlook, compared to only 37 per cent of general contractors, 29 per cent of subcontractors, and 31 per cent of engineers, architects, etc.

KPMG notes the high level of optimism with owners is important, as they represent the first link in the construction value chain. Their optimism suggests continued in projects will flow to the rest of the industry.

HITTING THE LABOUR WALL

The construction industry must find a way to do more with less.

The pandemic hastened the industry’s impending retirement crisis, prompting older workers to retire early and contributing to a tightening in the labour market. As many as 62,000 jobs nationwide currently need to be filled, estimates the CCA, and approximately 156,000 workers are expected to retire by 2028, according to BuildForce Canada.

As it stands today, the industry can’t keep up with today’s labour force requirements. Nine in 10 companies said that they are currently experiencing a labour shortage. That jumps to 94 per cent in Québec. Almost as many – 86 per cent nationally – say that the labour crunch is impacting their ability to bid on projects and/or meet project deadlines. In Québec, 94 per cent are also struggling to bid on new work and/or their projects are behind schedule. As many as 90 per cent of B.C. construction companies say their projects are also being impacted.

Technology offers ways for companies to weather the scarcity of labour. Eighty-six per cent of the companies surveyed – and again 94 per cent in Québec – say that they are considering prefabrication, modularization and innovative new tools and machinery to improve their efficiency and address the labour shortage. Nearly nine in 10 (89 per cent) agree that “better project management tools, that is, analytics, building information modelling (BIM), digital twins, etc., make labour more effective and help address shortages.”

The KPMG poll also finds that 91 per cent of construction companies across Canada believe the education system needs to be “much more flexible” to allow young people to pursue the trades. In Québec, that figure jumps sharply to 97 per cent.

The industry realizes that it’s not attracting the talent it needs and it can’t entirely rely on immigration to fill the gap. While education is one lever, technology is another. In the world of modern construction, technology can help to attract young workers who have grown up in a digitally interconnected technological world and want to make an impact in the greening of industry.

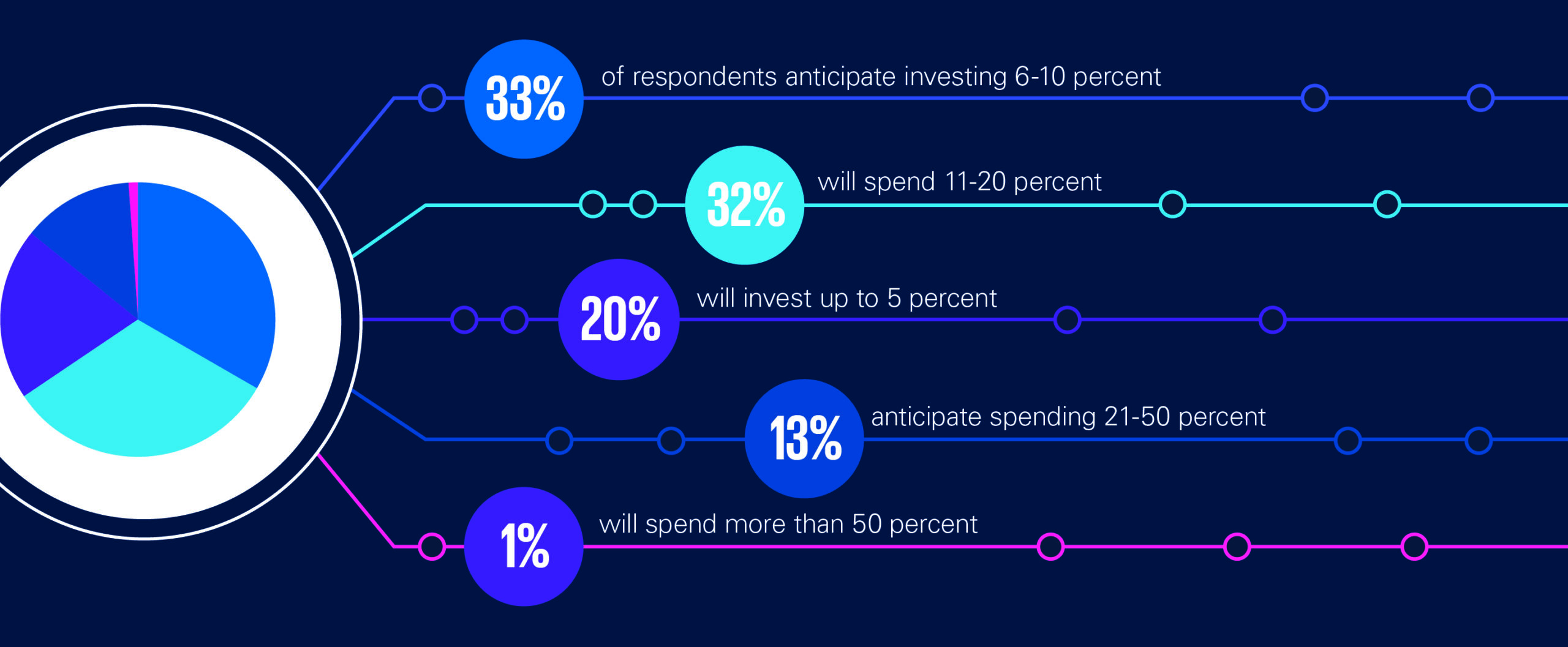

Anticipated tech and digital transformation spend as a percentage of their annual corporate operating budget. (Source: KPMG)

TECHNOLOGY ADOPTION: WHAT’S IN YOUR TOOLKIT?

The construction companies surveyed by KPMG intend to invest significantly in technology and digital transformation.

BIG DATA

You can’t digitally transform your organization without a fundamental data transformation. In an industry run on slim profit margins, companies that have a better handle on their data and can trust its veracity and quality will stand a far greater chance of delivering projects on or ahead of time, on or below budget, and delivering superior returns compared to their competitors.

Big data can reduce project costs and timelines, identify safety issues and material wastage, improve sustainability, and increase efficiency. Globally, many construction companies are using realtime, cloud-powered analytics of large and unstructured datasets.

Through predictive analytics, machine learning (ML) and artificial intelligence (AI), companies are better able to analyze historical material, time, personnel spend, and evaluate a project’s risk profile to help them decide if a project is worth bidding on, its cost and contingencies.

Big data has made a “great or considerable” positive impact for 40 per cent of the companies currently using it. However, 46 per cent say the extent to which it’s impacted their organization has been moderate or slight, and the remaining 14 per cent say it hasn’t significantly impacted their organization at all.

This begs the question as to the quality of the data that’s collected and fed into AI applications, and whether big data has in fact been truly understood or implemented.

Only 42 per cent of respondents have designed and implemented cloud computing to connect data sources and share information across project teams, and 42 per cent say their organization’s systems and processes are integrated to a “great or considerable extent.” Just 36 per cent say their corporate functions and internal departments share data effectively and as many as six in 10 (61 per cent) acknowledge that they are experiencing “significant issues” with data siloing.

Less than half (45 per cent) of survey respondents say they are using “data analytics effectively to make business decisions” and another 29 per cent leverage data analytics to a “moderate extent.” Fewer than half (only 44 per cent) use online document management or data repository tools with their clients and project teams to a “great or considerable extent.” About a third (34 per cent) are using ML and automation “to a great or considerable extent” on administration-type processes.

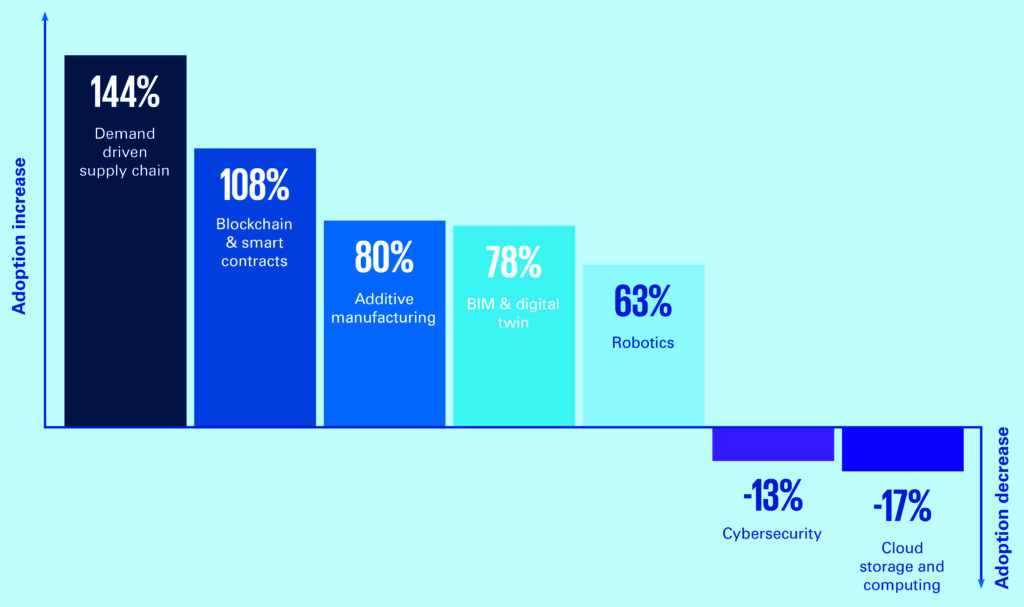

DEMAND-DRIVEN SUPPLY CHAIN

Demand-driven supply chain (DDSC) integrates links along the supply chain to anticipate demand and enable faster and more cost-effective delivery of materials and services. It requires visibility and transparency in the supply chain. While DDSC has been leveraged for years in the manufacturing industry, the pandemic highlighted the importance of active supply chain management in the construction sector.

Investments in new technologies intersect with DDSC to enhance supply chain management accuracy and effectiveness.

BIM AND DIGITAL TWINS

Building Information Modelling (BIM) uses 3D modelling to digitally render construction designs and analyze construction phases and site logistics, increasing both efficiency and productivity by providing a central repository for project data, providing critical project data spanning design criteria, materials, construction, cost, and warranty and operation documentation.

About a third (34 per cent) of respondents to the 2023 KPMG Construction Industry Digital Maturity survey say they are experienced “to a great or considerable extent” with BIM and digital twin technologies and the application of these two technologies in project delivery, while 28 per cent are experienced to a “moderate extent.”

ROBOTICS AND AUTOMATION

When asked the extent to which the surveyed companies are using robotics, such as drones, exoskeletons and collaborative robotics, nearly a third (32 per cent) say to a “great or considerable extent,” and a quarter (25 per cent) to “a moderate extent.” Sixteen per cent are using them “a little” and 28 per cent aren’t using robotics at all.

While the survey shows an increasing focus on robotics and automation, the survey authors believe this focus is primarily on investing in lower-cost technology, like drones. Expected payback times are getting shorter though, with most respondents (63 per cent) stating an expected payback time of less than three years for their technological investments, which is a shorter timeframe than when companies were surveyed three years ago.

Based on the survey findings, the key business case for robotics is worker health and safety, followed by schedule efficiency and productivity. This is aligned with the manufacturing sector, where automotive companies have already invested in such tools as exoskeletons to improve workplace and worker safety.

BLOCKCHAIN AND SMART CONTRACTS

Almost six in 10 companies surveyed plan to introduce, or are in discussions to implement, smart contracts built on blockchain technology, finds the research.

The objective is to improve transparency, accountability, and traceability. It’s a single source of truth covering all aspects of a construction project, and as such, can also deter fraud by eliminating suspicious and duplicate transactions. Information on purchased materials can be visible on the blockchain, including production and quality certificates.

INTERNET OF THINGS SENSORS

Canadian construction companies have various reasons for investing in wearables and Internet of Things (IoT) sensors, including to improve productivity, planning, estimating, sustainability and/or health and safety.

The survey finds that only 56 per cent have invested to a “great or considerable extent” (34 per cent) and to “a moderate extent” (22 per cent). Twenty per cent have invested “a little” and a quarter have not invested at all.

IoT sensors can cover a broad array of attributes including water, temperature, air quality and particulate counts to fire risks, the structural integrity of a building, monitoring proper curing and quality of concrete and more IoT sensors are immensely valuable on construction sites to detect and mitigate risks like water pipes freezing and potentially bursting in the winter.

Accordingly, IoT sensors offer an interesting value proposition to insurance companies which can use sensors to better understand and mitigate risk by requesting that construction companies deploy IoT technology to detect, mitigate and control risks and thereby reducing project risk, insurance claims and litigation.

CYBER RISK MANAGEMENT

The benefits of technology and digital connectivity are not without their risks. From ransomware to spear phishing and distributed denial of service (DDoS) attacks, cyberattacks in Canada are on the rise. No industry is immune.

Yet, fewer than four in 10 companies (38 per cent) surveyed for the KPMG 2023 Construction Industry Digital Maturity survey have implemented cybersecurity tools and technologies.

Only about a third (32 per cent) have definitive plans to implement cybersecurity technologies over the next three years and 17 per cent have put it on the table for discussion to implement. The remaining 13 per cent admit they have no plans to implement cybersecurity tools. No wonder then that over half (56 per cent) of those surveyed aren’t confident that their IT world is secure.

Six in 10 companies (62 per cent) also acknowledge their “flow-down” cyber compliance requirements or specifications to their suppliers could be clearer or better articulated.

As companies leverage technologies, such as robotics to assist in builds, drones to monitor worksites, and sensors and connected devices to operate smart buildings, they generate, collect, and store vast quantities of data. Cybercriminals are looking for vulnerabilities or ways in to steal personnel, account or financial records, architectural and engineering designs, intellectual property data, or confidential or sensitive project information, or to gain control of critical infrastructure.

Cyber breaches can result in both financial and reputational loss and could jeopardize work on future projects. While three quarters (76 per cent) are greatly, considerably, or moderately concerned about privacy breaches and potential risks associated with private data, over half (54 per cent) acknowledged that they have not fully considered the risks of using digital technologies nor quantified the financial risks.

Cybersecurity starts with awareness and identification, assessment, prevention and defence, and response. Increasingly, cybersecurity-related provisions are being included in construction projects and tailored to specific project needs and risks.

Do the terms of your supply and construction contracts cover cyber risks, provide early warning regimes, indemnification, or restrict the storage of data? Are there measures stipulating that sensitive information be destroyed or returned when the contract ends? Are security frameworks, testing and audit procedures in place?

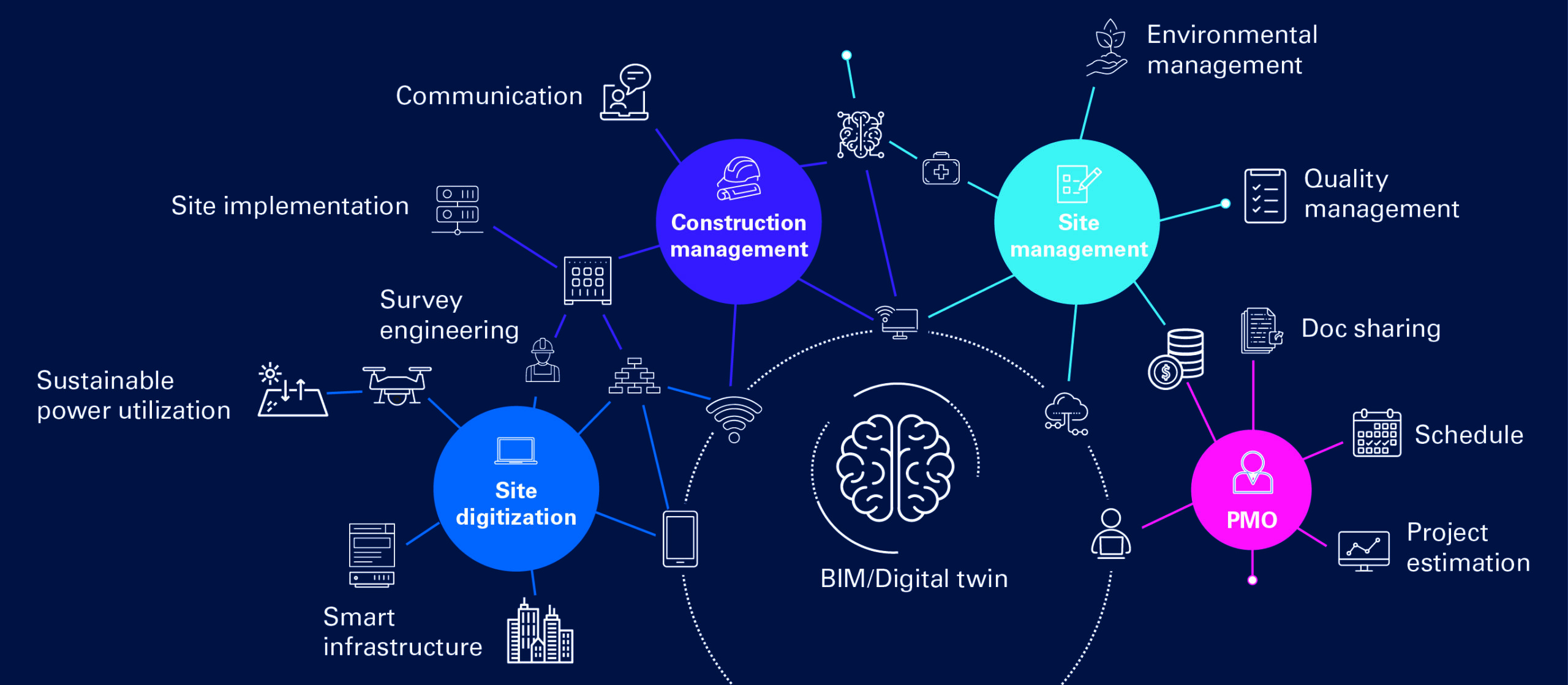

THE CONNECTED SITE

Projects create an enormous amount of valuable information. BIM and digital twin technology provide the ability to combine and integrate technology across the project team to develop a unified data model which will be what defines the construction landscape in the 21st century. We call it the “Connected Site.”

GETTING THE RIGHT PEOPLE AT THE TABLE

Are construction companies investing in the right technologies? Who makes the investment decisions? How supportive of technology use are your project teams and skilled trades? And how well is change management being communicated throughout the organization?

The unwillingness to change established ways of working is typically the biggest barrier for wider adoption of technology. This is particularly true in the construction industry. A successful digital strategy starts with board and executive sponsorship. But only 44 per cent of the companies surveyed say that top management assigns a “great” or “considerable” significance to digital transformation.

Department heads – those closest to identifying the organization’s needs and limitations – will need to play a larger role in guiding their organization’s digital maturity. They will also need to review their workforce capabilities. Forty-four per cent of companies surveyed say that digital transformation will require hiring new talent within their organization to a “great” and “considerable” extent and another 33 per cent say it will require hiring new talent to a “moderate” extent. Are there opportunities to reskill or upskill employees on various technologies? How effectively is your organization recruiting data scientists and technologists?

On the upside, there’s excitement in the air over change. Approximately eight in 10 companies say their project teams, workforce, and back-office teams are considerably or moderately “excited about and supportive of new technologies.”

THE NEXT 3 TO 5

In the 2020 edition of the report, KPMG posed the question, “Can you afford to wait?” The ensuing three years proved that companies can’t afford to wait.

The industry now recognizes that they must modernize or be left behind. The next three to five years could well be a “make or break” timeframe for many companies.

The authors of the 2023 KPMG report list several strategies to encourage the investment and use of technology in construction. These include:

- Developing an enterprise-wide strategy and tracking progress;

- Identifying business outcomes that intrinsically link technology to the business’s overall objectives;

- Building motivation and develop a change management plan;

- Attracting and retaining talent; and

- Partnering with trusted advisers.

Between late 2022 and March of this year, KPMG interviewed and surveyed 275 Canadian companies in the construction sector to produce the KPMG 2023 Construction Industry Digital Maturity report in collaboration with the Canadian Construction Association. On-Site Magazine would like to thank KPMG’s Tom Rothfischer and Jordan Thomson, and Mary Van Buren of CCA, for their work in bringing this research to our industry. To download a copy of the report, please scan the QR Code.

Between late 2022 and March of this year, KPMG interviewed and surveyed 275 Canadian companies in the construction sector to produce the KPMG 2023 Construction Industry Digital Maturity report in collaboration with the Canadian Construction Association. On-Site Magazine would like to thank KPMG’s Tom Rothfischer and Jordan Thomson, and Mary Van Buren of CCA, for their work in bringing this research to our industry. To download a copy of the report, please scan the QR Code.